Federal Student Loan Relief Is Ending

Here’s a rude awakening if you are one of the millions of millennials that financed part of your college education with help from the government: federal student loans currently on pause will come due starting in May 2022.

Of course, there are a lot of discussions currently going on in Washington about whether or not the Biden administration will eventually enact additional student loan relief.

One thing is certain: you should start making a plan now about how you will be paying back your loans. Unfortunately, hoping for or relying on what may or may not happen in Washington is not a plan. It’s important to develop the steps now that you will take to work towards financial independence.

Has Interest Accumulated on Both Private and Federal Student Loans?

Payments owed and interest accumulation on most federal student loans has been suspended once again. If you have federal student loans currently on pause, they would become due again starting in May 2022 unless other measures are enacted.

President Joe Biden extended the policy regarding federal student loans put in place by the Trump administration in 2020. However, this has no impact if you have outstanding loans through a private lender.

Private student loans continue to accumulate interest and are serviced as usual based on the plan you have worked out with your lender.

What Can I Expect When I Look At My Federal Student Loan Accounts Again?

It can be daunting to review your student loans, especially if you have not been paying attention during the relief period.

The good news is the details of your payments should not be too surprising. You can expect the same amount due each month based on the payment plan you previously set up prior to the student loan relief enacted in 2020.

For example, let’s say in February 2020, you were on a standard repayment plan and owed a minimum payment of $250 per month on a loan with an interest rate of 5%. If you have not made any extra payments on your loans during the relief period, you can expect this same payment structure in place once the minimum payments kick back in.

It’s a good idea to review your bank statements from previous months where you were making the minimum payments. You should also call your student loan service provider’s toll-free number to confirm the minimum amount that will be due.

What Should I Do If I Am Strapped for Cash and Not Ready for the Federal Student Loan Relief to End?

First and foremost, make sure you are aware of the payment plan you are currently on and the minimum amount that will be due each month. You can call your student loan service provider’s toll-free number to confirm the minimum amount that will be due.

It can be stressful to think about, but the most important thing you can do right now is have an awareness of your overall debt situation and know what your payment will look like. Ignoring your student loan situation will only lead to more stress and cash flow issues over time.

Explore your options for a more manageable repayment plan for your federal student loans.

For example, you could explore an income-driven repayment plan (IDR) or the public service loan forgiveness program (PSLF). If your minimum payments are not manageable, there are additional options you can explore with your provider.

You should also review and balance your budget to account for the minimum payments coming due. Not only will this give you an awareness of your overall cash flow situation, but it may allow you to free up some areas of your budget to apply extra payments to some of your highest interest student loans.

Are there areas of spending that increased during the pandemic? If so, were those categories more so in the necessary or discretionary category?

It sounds simple enough, but reviewing your current cash flow situation is vital as the student loan relief period comes to an end.

Should I Make Extra Payments During the Federal Student Loan Relief?

Some people have taken advantage of the current zero interest and payments for federal student loans and continued to make payments or even paid off some of their loans during this period.

If you are financially in a position to do so, it may be a good idea to be as aggressive as possible over the next few months in paying down your debt. Any extra payment would likely go towards principal only, reducing your interest expense over time and the total outstanding amount of your loan.

If you have not been making extra payments, you can still take advantage of the relief period by reviewing your overall financial situation, including your budget, to ensure you are in a better position to start your minimum repayments in May 2022.

You should not feel behind the pack, but rather use this relief time as an opportunity to improve your financial literacy and create a plan for paying off your debt.

Should I Consider Consolidating My Federal Student Loans?

One of the options people sometimes consider to manage their minimum payments is student loan consolidation and refinancing.

In some cases, refinancing your student loans can make sense, but there are pros and cons to consider. If your minimum payments are simply overwhelming and difficult to manage across all the different loans and lenders, refinancing for the sake of simplicity may be a beneficial option.

When you refinance your student loans, you are normally able to bundle multiple loans into one simple monthly payment at the newly determined interest rate.

However, this brings us to a serious con with the refinancing option: you may actually extend the life of your federal loans and potentially how much you pay back over time.

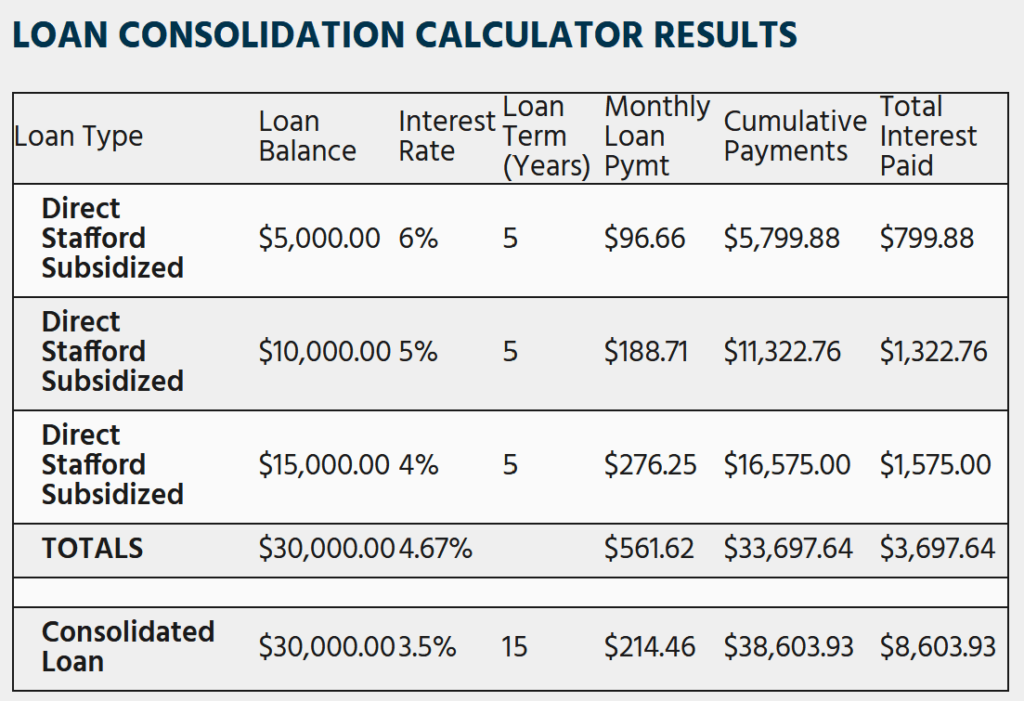

Think about it this way: let’s say you have one loan for $5,000 at a 6% interest rate, one loan for $10,000 at a 5% interest rate, and one loan for $15,000 at a 4% interest rate.

For the sake of simplicity, let’s assume all three loans have 5 years left of payments on a term of 10 years. You work with a loan consolidation company and are able to consolidate and refinance those three loans into one single loan. This results in a smaller monthly payment, but the total loan is now $30,000 at a 3.5% interest rate with a 15 year term.

Using a simple student loan consolidation calculator, if you stuck with a standard repayment plan in this example where you just made the minimum payments over the new 15 year term, you would actually end up paying roughly $4,900 more in interest!

The main point here is that just because a loan consolidation company offers you lower interest rate, it does not always make financial sense, especially if your repayment term is increased.

You should also strongly consider the fact that if you were to consolidate your federal student loans with a private lender, you would lose any of the rights associated with federal student loans. This would include losing rights like the current pause on interest accumulation and payments. This pause only applies to federal student loans.

Consolidation may make sense depending on your individual situation. There are important considerations before you make a decision to consolidate and other payment options available that should be explored.

Summary

There may well be more student loan relief on the horizon, but try to focus on your individual financial situation, how much debt you can pay off each month, and your time horizon for paying down that debt.

The political situation is dynamic and relying on what may or may not happen could easily derail any progress made toward a more financially independent lifestyle.

Do not hesitate to reach out to us to discuss your current student loan situation and how we can help you craft a plan to tackle your debt.

Before you take on any investment or retirement strategy, it is vital that you seek out proper investment and tax advice beforehand. Investment performance is never guaranteed and investments may lose some or all of their value. On top of that, there may be severe tax consequences if withdrawals are taken improperly and can have a significant impact on your portfolio and retirement. Although we provide Investment Advice and Personal Financial Planning Services, we at MWM do not provide tax advice and any tax advice should be rendered by a licensed tax professional such as a CPA.

Securing Your Future With Premier Financial Solutions

The world of finances is riddled with complexities. From student loan repayments and debt management to asset allocation and retirement planning, millennials face much uncertainty when it comes to managing their wealth. Therefore, we at Millennial Wealth Management strive to provide a new approach to financial advice that not only enhances your level of financial literacy but also presents curated solutions that are tailored to help you achieve your life goals. Our team is equipped with the tools and expertise to analyze your current financial situation while also setting you up for future success. Visit our website or call a member of our team today and make the first step to taking control of your finances with confidence.