5 Retirement Savings Tips for Millennials

Younger generations are dealing with challenging economic realities when it comes to saving for retirement. A good percentage of those in the gen z and millennial generation are graduating with student loan debt and dealing with a hot housing market all while trying to manage a budget on stagnant wage growth over the past few decades.

Here’s the good news for millennials: you have time on your side. It’s true that the oldest millennials are now in their 40’s and therefore have a shorter time horizon until retirement, but the fact is this generation has time to make the needed adjustments to optimize their retirement savings situation.

There are steps you can take today to optimize how you save for retirement and ultimately, financial independence. It’s important not to let the inertia of having too many choices or even feeling like you’re behind on saving for retirement stop you from taking steps towards improving your bottom line.

1. Start Contributing to Your Employer Sponsored Retirement Plan ASAP

If your current job offers you a retirement plan, like a 401(k) or 403(b) for example, review the details of the plan and learn how to participate as soon as possible. Figure out if your plan offers you the ability to make Roth contributions in addition to traditional pre-tax contributions.

Traditional pre-tax contributions are excluded from your taxable income but distributions are taxed as ordinary income when you take the money out in retirement.

Roth contributions are put into your retirement account after taxes are taken out, but the benefit is tax-free income in retirement, provided certain conditions are met.

At a minimum, start contributing enough to get your employer’s match which is essentially free money. Even if your employer does not offer a match, aim to get to a contribution rate that is sustainable based on your current financial situation. Consider maxing out your employer sponsored retirement plan up to the IRS contribution limits if you are in a position to do so.

2. Make Sure Any Investment Strategy Aligns With Your Overall Goals, Risk Tolerance and Time Horizon

You also want to make sure you have a clear understanding of how you are investing the money you contribute to your retirement account. Setting your contribution amount is only the first step as you also need to make sure you choose what funds to invest in.

For example, many employer sponsored retirement plans automatically default their plan’s participants into an age appropriate target date fund. This type of fund is designed to become less risky as you approach retirement.

Your employer sponsored retirement plan is most likely self-directed, meaning you choose how to invest your money, so it’s important that you are invested appropriately based on your risk tolerance and time horizon to retirement.

3. Leverage The Power of Compound Interest

Contributing to your employer sponsored retirement plan or any investment account in your 20s and 30s provides you a massive benefit over the long term due to the impact of compound interest.

This is how compound interest works: let’s say you have $100 to invest which grows at 10% per year. At the end of year 1, you would have $110, making $10 on top of your initial investment. At the end of year 2, you would have a total of $121, because the 10% return is now being earned on the $110 total from last year. Of course, this is only an example and returns are never guaranteed.

This is the power behind compound interest, that your balance continues to snowball over time as growth is earned on your underlying investments.

The earlier you start saving and investing, the greater the growth potential when it comes to the power of compound interest. Starting your retirement savings early also makes it less likely you will have to contribute more money in your 40s and 50s to “catch up.”

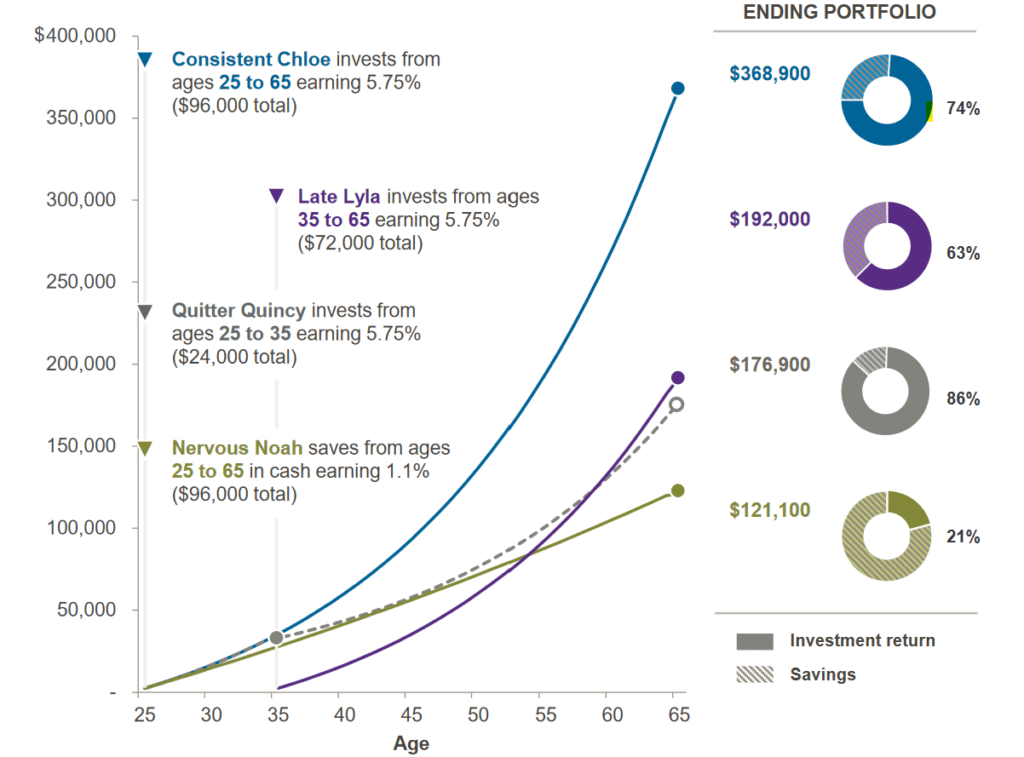

Consider the example provided in J.P. Morgan’s recent addition of Guide to Retirement showing four different scenarios regarding an account growth of $200 invested and saved monthly.

Assuming a 5.75% rate of return across all accounts, this example does a good job illustrating the power of investing over a long period of time while being consistent with how much you save and invest on a periodic basis.

The key to leveraging the power of compound interest is focusing on the long term, staying the course when markets look volatile, investing appropriately, and remaining consistent in your approach.

4. Consider the Potential Benefits of Funding a Roth IRA

If you do not have a retirement plan offered through work, consider opening and funding a Roth IRA. There are income limits set by the IRS which determine whether or not you would be eligible to contribute. If your income is too high to be able to contribute, you can explore a backdoor Roth IRA contribution, whereby you make a non-deductible traditional IRA contribution and later convert those assets to a Roth IRA. Currently, there are no income limits on Roth conversions.

Roth IRAs have a number of investment options available including individual stocks and bonds, ETFs, and mutual funds. Contributions to a Roth IRA are made with after tax dollars and earnings grow tax-free.

The tax advantages of a Roth IRA can be especially beneficial for people in their 20s and early 30s. This is because you are typically at a lower tax bracket earlier in your career and paying taxes at today’s rate versus a potentially higher rate in exchange for tax-free investment growth can be advantageous.

As long as you meet certain conditions, qualified distributions in retirement from a Roth IRA are tax-free.

5. Understand the Concept of Opportunity Cost

While retirement for the millennial generation may be decades away, understanding the concept of opportunity cost and how it relates to your money decisions can have a profound impact on your road to financial independence.

Simply put, opportunity cost is the loss of a potential gain from an alternative choice not taken. We all make choices with our money, whether consciously or subconsciously.

Take for instance deciding to leave your money in cash rather than investing it in the stock market. It’s true that investing in stocks comes with the risk of loss, but leaving your money in cash or your retirement portfolio positioned overly conservative is a choice in itself. Opportunity cost in this case comes in the form of losing out on potential returns of stocks had you decided to invest the funds instead.

While you may not consider leaving your money in cash “safe” and “not risky”, that is not necessarily the case. In fact, a major risk in your portfolio is the impact of inflation over time, thus reducing your purchasing power for that money had you invested it instead.

Consider the opportunity cost with every money decision and evaluate the alternative choices in front of you, especially with a longer time horizon.

Summary

Of course, any decision made to fund your employer sponsored retirement plan or any type of retirement account and what to invest in should align with your overall goals, risk tolerance and financial plan.

The current economic situation for most millennials is certainly challenging, but that does not mean you cannot take steps today toward a more financially independent future. Making small sacrifices today and putting a solid financial plan in place can pay massive dividends for your future self.

After all, our ultimate goal in working with you is to help put you in a position where you can decide when to stop working or maybe start that business you have always wanted to.

As always, do not hesitate to contact us with any questions or if you just need some ideas on how to allocate the income.

Before you take on any investment or retirement strategy, it is vital that you seek out proper investment and tax advice beforehand. Investment performance is never guaranteed and investments may lose some or all of their value. On top of that, there may be severe tax consequences if withdrawals are taken improperly and can have a significant impact on your portfolio and retirement. Although we provide Investment Advice and Personal Financial Planning Services, we at MWM do not provide tax advice and any tax advice should be rendered by a licensed tax professional such as a CPA.

Securing Your Future With Premier Financial Solutions

The world of finances is riddled with complexities. From student loan repayments and debt management to asset allocation and retirement planning, millennials face much uncertainty when it comes to managing their wealth. Therefore, we at Millennial Wealth Management strive to provide a new approach to financial advice that not only enhances your level of financial literacy but also presents curated solutions that are tailored to help you achieve your life goals. Our team is equipped with the tools and expertise to analyze your current financial situation while also setting you up for future success. Visit our website or call a member of our team today and make the first step to taking control of your finances with confidence.