Traditional vs. Roth 401(k) Contributions

The different ways you can save for retirement is staggering. On top of that you need to decide what type of contribution to elect into your account (traditional, Roth, post-tax, pre-tax, etc.) Many people in the corporate or private sector have access to a 401(k) plan. This provides employees a tax-advantaged way to defer (set aside) a percentage of each paycheck into their retirement plan.

It’s tempting when you start a new job to simply set your contribution percentage and think you’re good to go. The reality is you need to consider how best to optimize how you are saving for retirement.

This is especially true when it comes to deciding the type of contribution you want to make to your workplace retirement account. Type in this context means making either a traditional pre-tax 401(k) contribution or a post-tax Roth 401(k) contribution (assuming your current plan permits Roth contributions).

What is the difference between a traditional pre-tax 401(k) contribution and a post-tax Roth 401(k) contribution?

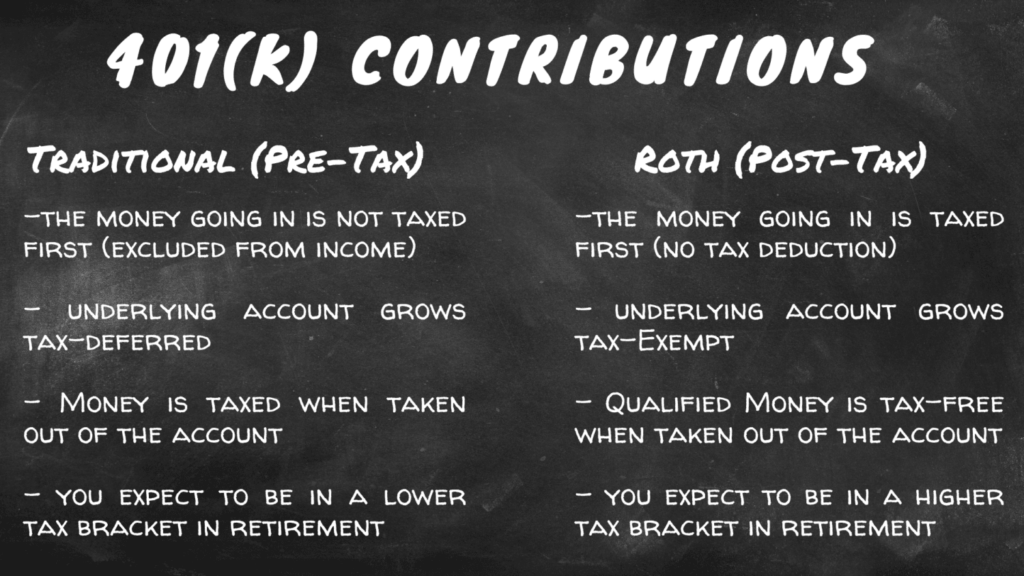

The difference between these types of contributions has to do with taxes. When you make a traditional pre-tax 401(k) contribution, the money comes directly from your paycheck BEFORE any taxes are taken out. This can reduce your taxable income for the amount contributed in that calendar year as the contributions are excluded (deducted) from your income. The money in the account then grows tax-deferred, meaning no tax is due on the growth until distributions are taken out of the account.

For example, you contribute $10,000 in 2021 in traditional pre-tax 401(k) money. Let’s say your income was initially $100,000 in 2021. After accounting for the traditional 401(k) contribution, your adjusted gross income (AGI) would actually be $90,000, thus reducing the income you would owe taxes on that year.

With traditional pre-tax 401(k) contributions, you get the tax benefit on the front end, but you will pay income taxes on any money that comes out of the account in the future.

When you make a post-tax Roth 401(k) contribution, the money comes directly from your paycheck AFTER taxes are taken out and you DO NOT get a tax deduction for the amount contributed in that calendar year.

However, the MASSIVE benefit of having money set aside in a Roth 401(k) is that the money that comes out of the account is completely tax-free, earnings too! This is as long as you take a qualified distribution after age 59.5 and subject to certain provisions.

How do you know if you are permitted to make a traditional pre-tax 401(k) contribution or post-tax Roth 401(k)?

If you have access to a 401(k) plan through your employer, you can make traditional pre-tax contributions via paycheck deferral. Whether or not you are also eligible to make post-tax Roth contributions depends on your plan’s provisions.

The good news is that a growing number of 401(k) plans allow employees to make Roth contributions. There are no eligibility restrictions based on income for making 401(k) contributions, whether traditional or Roth.

Of course, there are annual contribution limits established by the IRS and if your plan has a matching contribution, there is a compensation limit taken into account.

When should you consider traditional pre-tax 401(k) contributions?

The tax advantaged opportunity for making traditional 401(k) contributions can be especially attractive for high income individuals that want to reduce their taxable income.

For example, consider the scenario where your income puts you just above the next tax bracket. You could potentially stay in a lower income tax bracket that year by taking advantage of making traditional 401(k) contributions. Always confirm with your financial planner and CPA before making a decision related to taxes.

When should you consider post-tax Roth 401(k) contributions?

If you expect your tax bracket to be higher in the future than it is today, it can make sense to take advantage of Roth contributions to ensure you have tax free income in retirement.

Younger employees, and therefore lower income, have a great opportunity to utilize Roth 401(k) contributions given that they will likely start their careers in a lower tax bracket (taking the tax hit today) and have decades of potential tax-free growth ahead.

The fact is, no two situations are alike and the end goal is aligning your retirement contributions with your overall plan and values. While tax rates in the US are at a historically low point, it’s impossible to predict where they will be 30 to 40 years from now.

That uncertainty around taxes may be a valid reason for socking away as much as you can into Roth accounts given their tax exempt nature. Always work with your financial planner and CPA to determine what makes sense for your individual situation.

When should you consider both types of contributions?

If your 401(k) plan offers both traditional and Roth contributions, you have the option to do either type, one type, or both types. For example, assuming you contribute a total of 10% per paycheck, you may choose to split 5% for traditional and 5% for Roth.

You might consider doing both types of contributions because of the uncertainty about future tax brackets and to diversify across tax buckets. In the same way diversification makes sense across different asset classes, it can be advantageous to have a mix of taxable, pre-tax, and tax-free Roth balances across your accounts.

It always makes sense to consult with a financial planner or CPA to tailor the asset location plan to your situation as there’s no one size fits all approach to taxes.

What is a Required Minimum Distribution (RMD) and how does it work?

A required minimum distribution (RMD) is an IRS provision that mandates taxpayers to take a minimum amount from their retirement plans and/or IRAs each year beginning the year they turn 72. This effectively ensures the money in the account can eventually be taxed.

401(k) plans and other workplace retirement plans are subject to the RMD requirements, whether the account is pre-tax traditional or post-tax Roth.

The RMD amount is based on the IRS Uniform Lifetime Table and the prior year end balance as of December 31st. Generally, the institution where the assets are held can easily track this and will typically send out reminders.

Keep in mind that it is ultimately the taxpayer’s responsibility to make sure the total RMD amount is taken each year. Otherwise, you may face a 50% tax penalty on the amount not taken!

Can you avoid the RMD requirement by rolling over a Roth 401(k) into a Roth IRA?

Even though Roth 401(k) assets are still subject to RMDs, Roth IRAs are not subject to RMDs unless the assets are inherited.

It’s possible to avoid having to take RMDs if the assets are rolled from a Roth 401(k) to a Roth IRA, but there are factors to consider before you decide to rollover any assets from a workplace account to an individual one.

What are some factors you should consider if you are thinking about rolling a Roth 401(k) into a Roth IRA?

The biggest factor to consider when thinking about rolling money from a Roth 401(k) to a Roth IRA is the 5-year rule for Roth IRAs withdrawals.

Assuming you are at least 59.5, in order to take a qualified (tax and penalty free) distribution from a Roth IRA, you must take the withdrawal no earlier than 5 tax years from the date the first contribution to the Roth IRA was made.

The good news is that once you satisfy the requirement for one Roth IRA, you’ve completed the requirement as it is not account specific.

If you think you’ll need to take distributions soon, either for retirement or something else, and you haven’t already contributed to a Roth IRA at least 5 years ago or more, it might not make sense to rollover the Roth 401(k) to a Roth IRA given the restrictions.

Summary

Ideally, you have access to both traditional pre-tax and post-tax Roth contributions in your 401(k) or employer sponsored retirement plan. This gives you the flexibility to optimize your overall tax situation year over year and work with your financial planner to make changes as needed.

Depending on your tax situation, some people may benefit from being able to lower their taxable income by making traditional pre-tax 401(k) contributions, while others may benefit from tax-free growth and income in retirement from Roth 401(k) contributions.

As previously mentioned, it doesn’t necessarily need to be one or the other as a combination of both contribution types can make sense to diversify your tax buckets for retirement, but this is specific to your individual situation.

Work with your financial planner to determine how your plan works and what type of contribution to utilize. At the end of the day, the end goal for us is to help you become financially independent and informed about your money!

Before you take on any investment or retirement strategy, it is vital that you seek out proper investment and tax advice beforehand. Investment performance is never guaranteed and investments may lose some or all of their value. On top of that, there may be severe tax consequences if withdrawals are taken improperly and can have a significant impact on your portfolio and retirement. Although we provide Investment Advice and Personal Financial Planning Services, we at MWM do not provide tax advice and any tax advice should be rendered by a licensed tax professional such as a CPA.

Securing Your Future With Premier Financial Solutions

The world of finances is riddled with complexities. From student loan repayments and debt management to asset allocation and retirement planning, millennials face much uncertainty when it comes to managing their wealth. Therefore, we at Millennial Wealth Management strive to provide a new approach to financial advice that not only enhances your level of financial literacy but also presents curated solutions that are tailored to help you achieve your life goals. Our team is equipped with the tools and expertise to analyze your current financial situation while also setting you up for future success. Visit our website or call a member of our team today and make the first step to taking control of your finances with confidence.